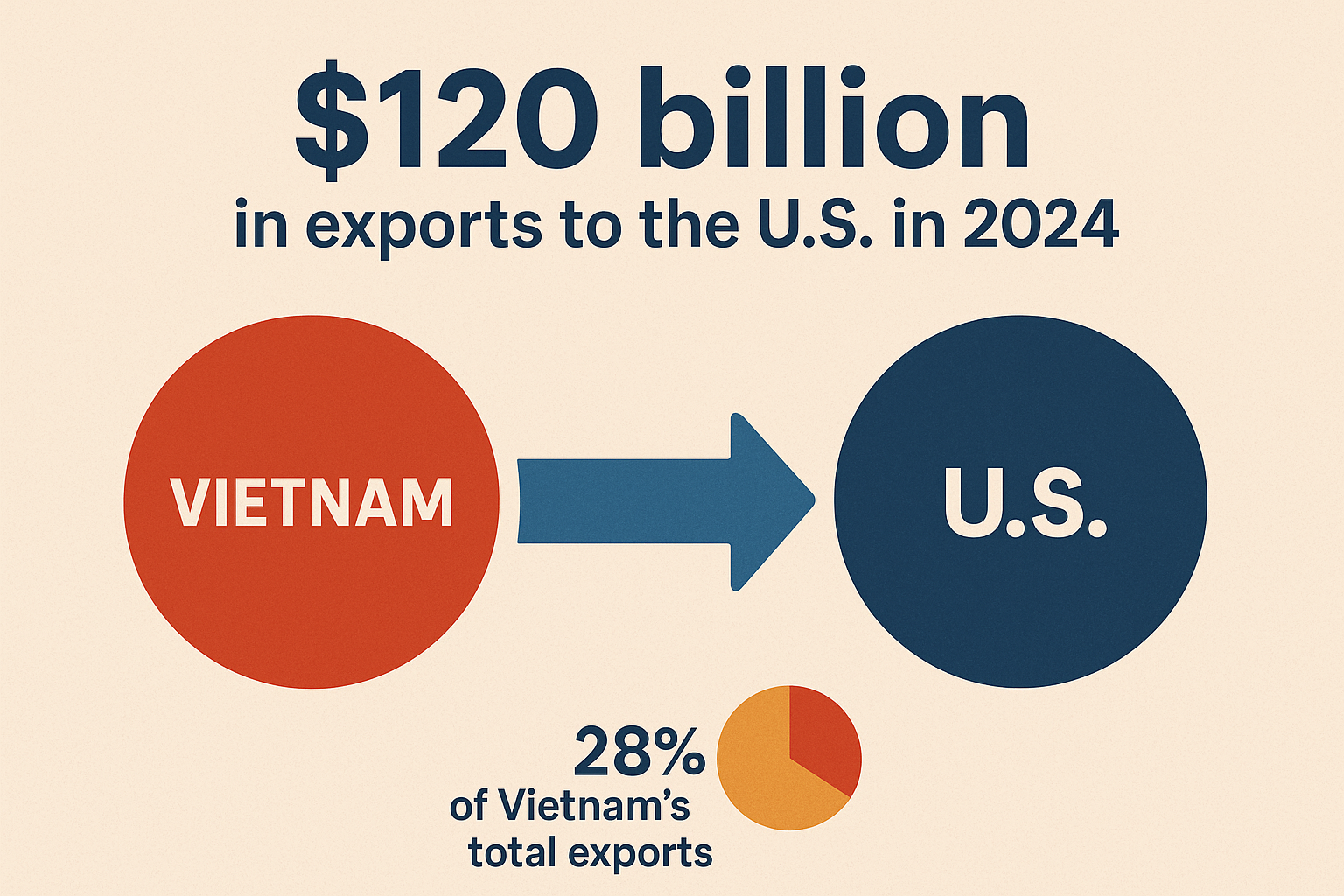

Vietnam’s Exports to the U.S. Near $120 Billion in 2024: A Strategic Leap if Trade Talks Succeed

Amid global economic uncertainties, Vietnam’s exports to the United States reaching nearly $120 billion in 2024 marks not only a significant trade milestone but also highlights the country’s increasing influence in global supply chains. More importantly, if upcoming strategic trade negotiations between Vietnam and the U.S. succeed, this could become a springboard for a new phase of economic growth, where Vietnamese goods don’t just appear in the U.S. market — they command it.

A Strong Surge: The U.S. Remains Vietnam’s Top Export Market

According to the General Statistics Office of Vietnam, in 2024, the country’s exports to the U.S. totaled nearly $120 billion, accounting for about 28% of Vietnam’s total export value — making the U.S. not only its largest but also its most vital trade partner.

Key export categories to the U.S. included:

Textiles and garments: Nearly $18 billion, up 8% from 2023.

Footwear: Around $10 billion, maintaining strong performance.

Wood and furniture: $9.5 billion, recovering after a downturn in 2022–2023.

Electronics and components: Close to $24 billion, playing a key role in growth.

Agri-aquatic products: Though smaller in scale, showed impressive growth, particularly in processed seafood and fresh fruits.

Analysts note that this impressive figure is not solely the result of production capacity — it also reflects how Vietnamese businesses have rapidly adapted to seize opportunities arising from global supply chain realignments, disruptions in China, and the U.S. push for supply diversification.

Trade Talks: The Trigger for Vietnam’s Next Leap Forward

As mentioned in a post by TikTok user @economyx2, Vietnam and the U.S. are currently engaging in important trade negotiations aimed at removing technical and tariff barriers to facilitate smoother bilateral commerce.

So what if the deal goes through?

1. Tariff Reductions Will Boost Vietnam’s Price Competitiveness

At present, many Vietnamese goods entering the U.S. still face tariffs ranging from 8% to 20%. A successful agreement could reduce these rates, allowing Vietnamese products to be priced more competitively — a key factor in a price-sensitive U.S. market.

2. Access to Green Investment and Supply Chain Support

The U.S. is actively promoting green and transparent supply chains. If Vietnam qualifies for U.S. investment and technology support programs, even small and medium enterprises (SMEs) could gain access to resources that help them meet sustainability and traceability standards.

3. Positioning Vietnam as a Trusted Alternative to China

Post-pandemic and amid U.S.-China tensions, Washington is seeking reliable new manufacturing partners. With its stable political environment, robust production capacity, and port infrastructure, Vietnam is emerging as the most promising strategic partner in Southeast Asia.

Behind the Headlines: Hidden Risks and Strategic Challenges

Reaching $120 billion is a major success, but it also brings new pressures and responsibilities if Vietnam wants to maintain — or grow — its position in the U.S. market.

The U.S. frequently imposes anti-dumping, countervailing duties, and strict origin rules, especially on wood, seafood, steel, and more. Vietnamese exporters must strengthen legal compliance and supply chain transparency to avoid being penalized.

U.S. retailers increasingly demand eco-friendly production, social compliance, and traceability. Without timely transformation, Vietnamese goods risk being excluded from giants like Walmart, Target, and Amazon.

Bangladesh, India, Mexico, and Indonesia are all aggressively expanding into the U.S. market. If Vietnam cannot boost productivity, diversify offerings, and control costs, it could lose its hard-won market share.

How Can Vietnam Turn This Momentum Into Long-Term Value?

To turn this “trade opportunity” into a sustainable competitive advantage, Vietnam needs coordinated strategies from government to businesses:

At the Government Level:

Push for bilateral trade agreements that offer preferential tariffs for core industries.

Invest in logistics, seaports, and green manufacturing infrastructure to reduce export costs.

Create early-warning systems for trade risks to help businesses stay proactive.

At the Business Level:

Standardize processes, ensure traceability, and improve transparency.

Focus on higher-value-added products, rather than raw material exports.

Boost legal and regulatory understanding of U.S. trade practices and collaborate with industry associations for insights and support.

Conclusion: From $120 Billion to Global Supply Chain Powerhouse

Vietnam’s near-$120 billion export figure is not just a trade record — it’s a mirror reflecting the nation’s new role in the global economy. If Vietnam can capitalize on upcoming trade negotiations with the U.S. while continuing domestic reforms, it can set its sights not just on maintaining this level, but reaching $150–$200 billion and becoming a true global export powerhouse.

Leading fashion brands have already recognized Vietnam’s potential. Adidas, for instance, now produces over 40% of its global footwear in Vietnam, while Nike operates with more than 100 suppliers in the country. This shift is not only about cost reduction—it’s about securing a reliable, high-quality, and scalable production base.

Looking for producing garment in Vietnam?